Bonus Depreciation 2025 Percentage Formula. It allows a business to write off more of the cost of an asset in the year the company starts using it. You can deduct the $300,000 on your corporation’s 2025 federal income tax return.

Bonus depreciation allows qualifying businesses that spend more than the 2025 section 179 limit to depreciate up to 60% on the remaining purchase amount. In 2025, the bonus depreciation rate will drop to 60%, falling by 20%.

Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first year.

Bonus Depreciation For 2025 Dido Myriam, Bonus depreciation vs section 179. Bonus depreciation is an accelerated depreciation method that allows taxpayers to report a larger percentage of depreciation in the year that the asset was bought and put in service.

Depreciation Cost Limit 2025 Starr Emmaline, However, there are differences in their. Bonus depreciation rate (e.g 100% for 2025) x cost of the eligible asset.

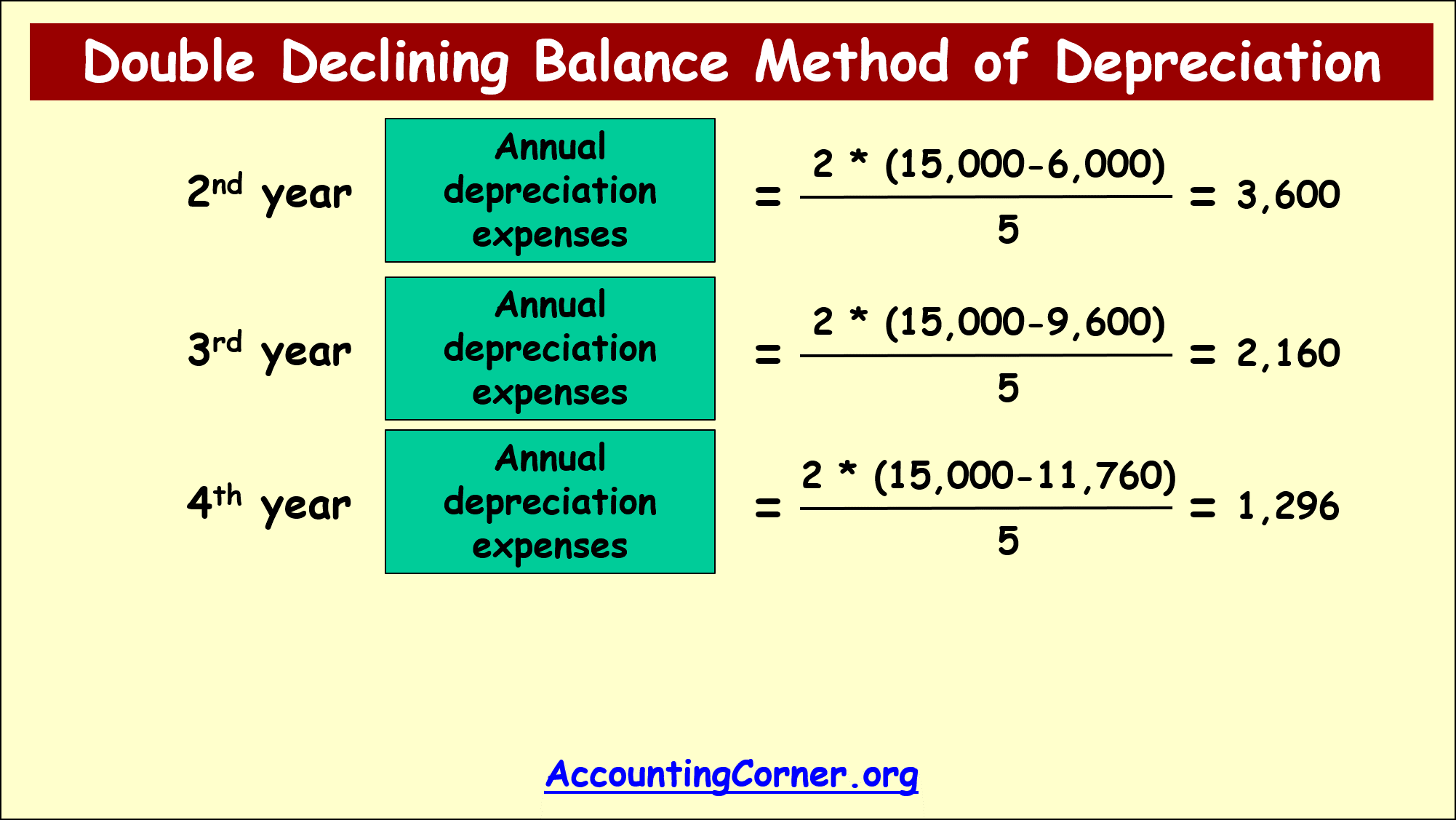

Depreciation Rules For 2025 alma octavia, Bonus depreciation is a way to accelerate depreciation. Here’s what that schedule looks like:

Section 179 Bonus Depreciation 2025 Tine Adriana, 100 percent for property placed in service after september 27, 2017, and before january 1, 2025; For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of $8,000, for a.

2025 Bonus Depreciation Percentage Calculator Selle Danielle, On the other hand, bonus depreciation, particularly under the current laws set to phase down starting in 2025 leading into 2025, allows for a percentage of the cost of qualifying business. You can then deduct 60% of the remaining $200,000 ($500,000 − $300,000), thanks to.

2025 Bonus Depreciation Rules Blair Chiarra, You can deduct the $300,000 on your corporation’s 2025 federal income tax return. For 2025, businesses can take advantage of 80% bonus depreciation.

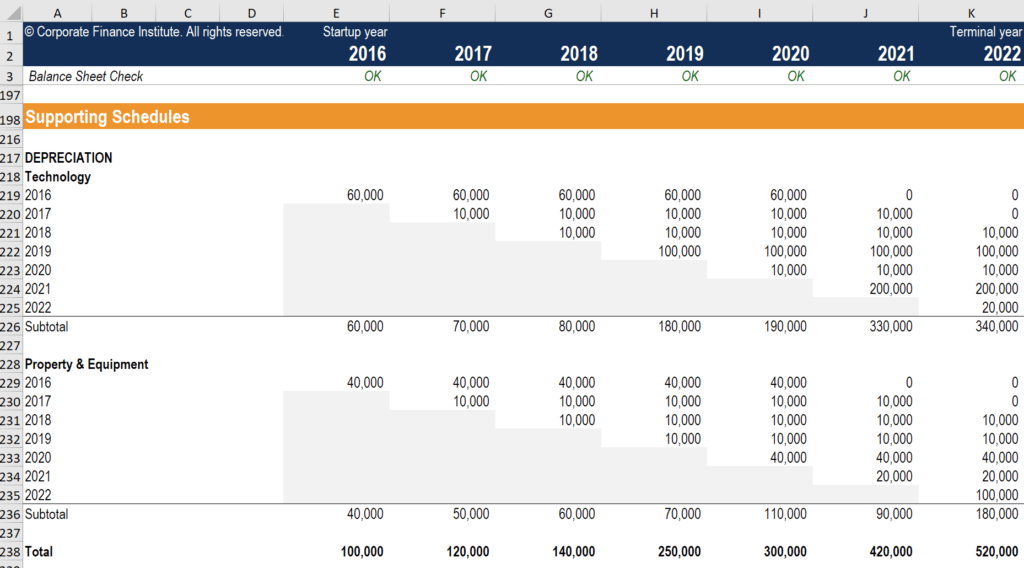

2025 Bonus Depreciation Percentage Table Debbie Kendra, After the bonus depreciation calculation, the. The remaining $4,000 will be depreciated in future years according to.

8 ways to calculate depreciation in Excel (2025), In 2025, the bonus depreciation rate will drop to 60%, falling by 20%. Bonus depreciation allows qualifying businesses that spend more than the 2025 section 179 limit to depreciate up to 60% on the remaining purchase amount.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, Calculate your bonus depreciation effortlessly with our html bonus. That is, by claiming bonus depreciation,.

2025 Bonus Depreciation Percentage Table Debbie Kendra, Thanks to the tax cuts and jobs. It allows a business to write off more of the cost of an asset in the year the company starts using it.

Bonus depreciation allows qualifying businesses that spend more than the 2025 section 179 limit to depreciate up to 60% on the remaining purchase amount.